If there’s one thing I’ve learned after 10+ years in commercial real estate:

Most companies don’t realize how much their office lease impacts their bottom line.

Whether you’re opening your first office or relocating your headquarters, here’s what I wish every business leader knew before making their office decision:

Your lease is more than a lease agreement, it’s a business strategy.

A lease shapes your cash flow, flexibility, and company culture. Before touring a single property, get clear on your growth plan, hiring goals, and space needs. Here are a few considerations: Where do majority of your talen pool lives? What is demographics of those you plan on hiring? How do you want your team to ulitize the office space? The right lease supports your vision and just your square footage.

Square footage can be deceiving.

Two offices might both be 5,000 square feeet but one could feel half the size. Why? Layout efficiency, column spacing, and what counts as usable vs. rentable square footage. Knowing the difference between the useable and rentable with give the answer to why one “feels” bigger. Rentable square feet has a common area factor included for the shared common areas such as elevators, restrooms, stairwells, stairwelss and Tenant ammentities like conference rooms. Multistory buildings you see in Westshore, Downtown St Petersburg and Downtown Tampa area rentable buildings. Useable includes a space has their own entrance directly into the Suite, restrooms inside and does who have any shared common area space.

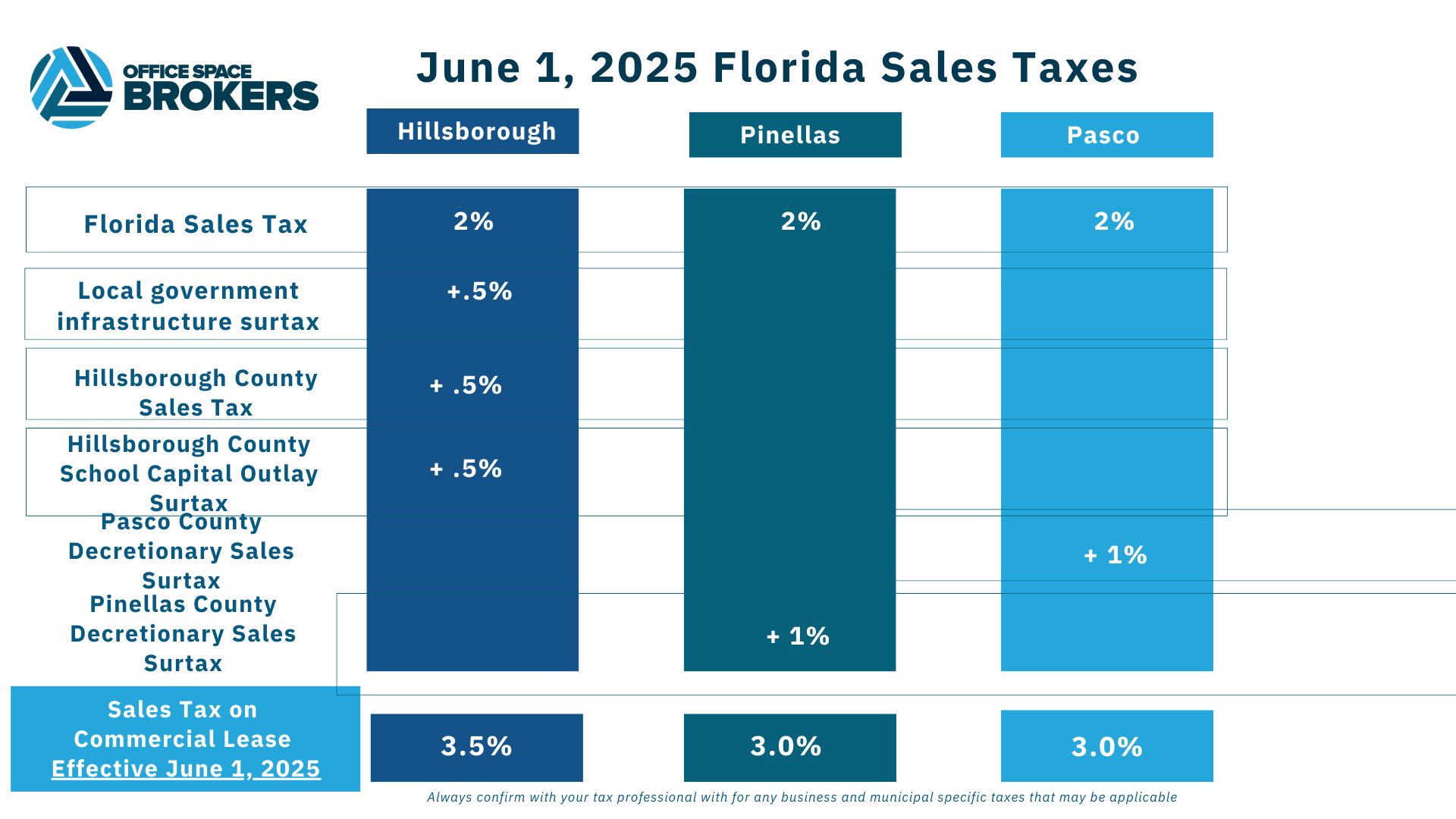

Watch the hidden costs

Your “base rent” is just the beginning. Operating expenses (CAM, taxes, insurance, janitorial, parking) can swing your total cost dramatically. Even in Full Service leases, there is still expenses a Tenant can be responsible before in the event the Operating Expenses surpass the Tenant’s bse year. Negotiate caps on increases or base year structures to protect your budget.

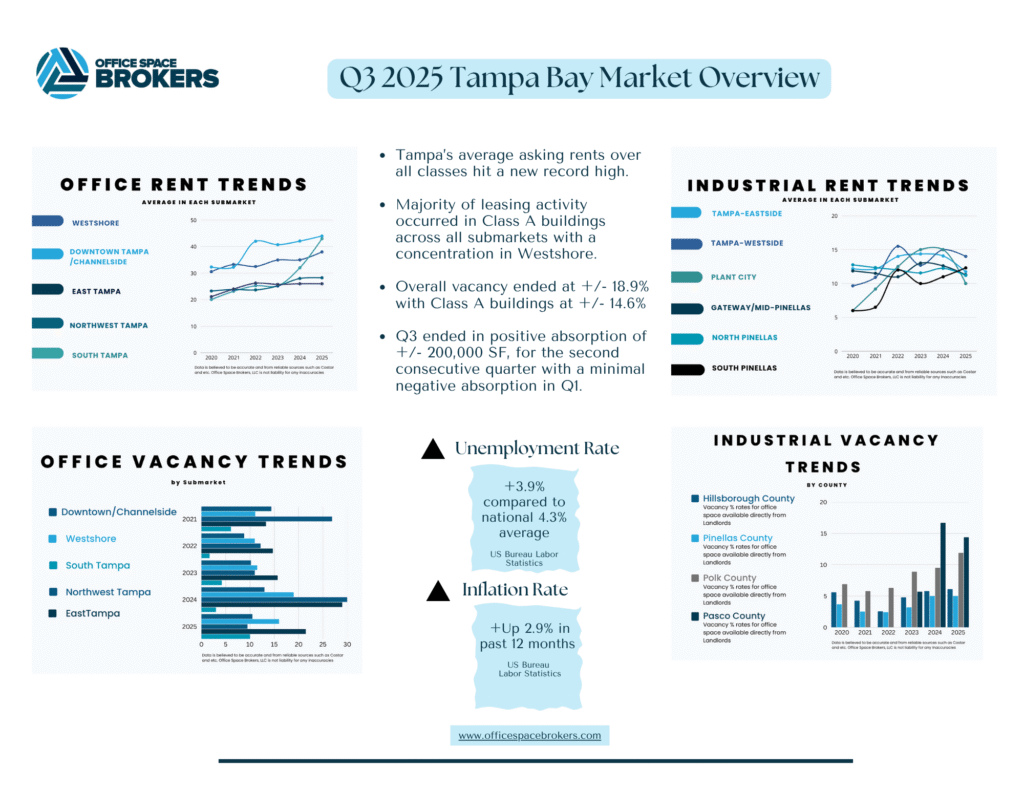

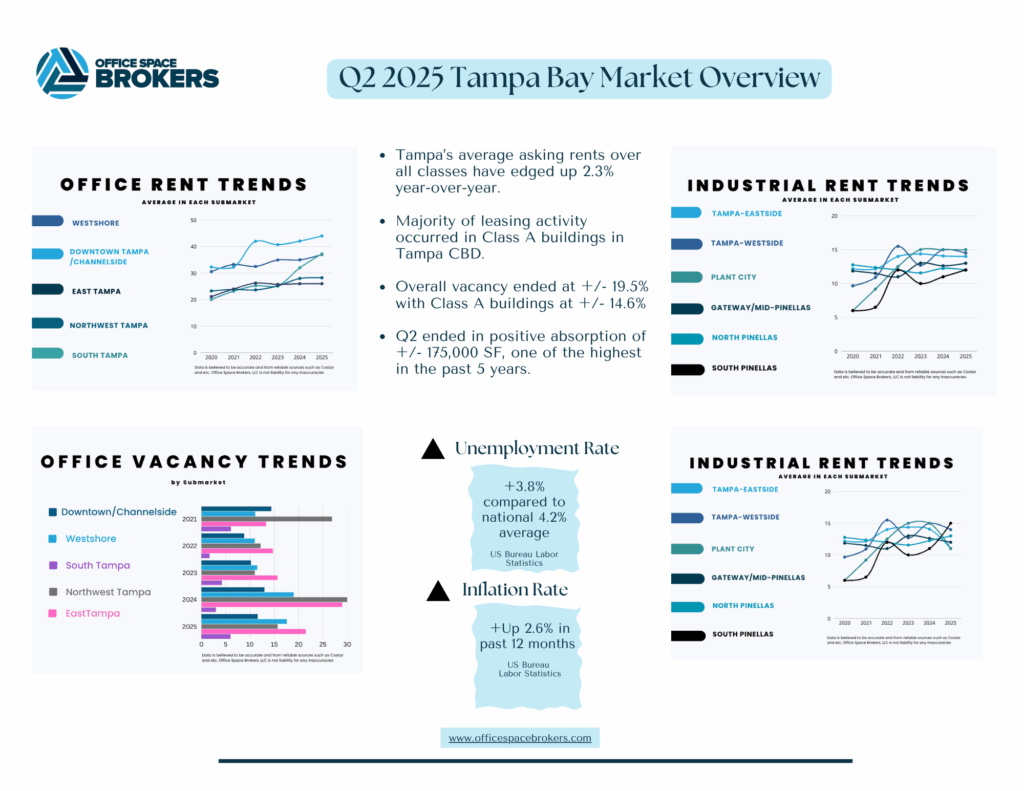

Timing is everything in Tampa’s market.

In submarkets like Westshore, Downtown, and Midtown, prime space goes fast especially for custom build outs. Start early (ideally 9–12 months before your lease ends).The earlier you plan, the more leverage you have.

Flexibility and lowest rent are not synonymous.

Shorter terms can give your business the flexibility it needs and worth the premium you pay when your company’s future is uncertain during growth mode. Making sure your lease grows with your company is important with first right of refusal to adjacent space that might come available, having favorable sublease terms and etc.

Representation matters.

Landlords have Brokers working for them, you should too. enant Representation Broker advocates only for your interests, helping you uncover hidden opportunities, negotiate better terms, and avoid costly oversights. Here’s the secret: Landlords pays Tenant Representative broker’s fee.

Final Thought

Leasing office space isn’t just about location or price, it’s a business decision that directly and indirectly impacts a company’s bottom line. A great space supports your growth, inspires your team, and strengthens your bottom line.

If you’re planning to lease or renew in Tampa Bay, let’s talk.

Even a 15-minute strategy chat can save you months of stress and thousands of dollars.