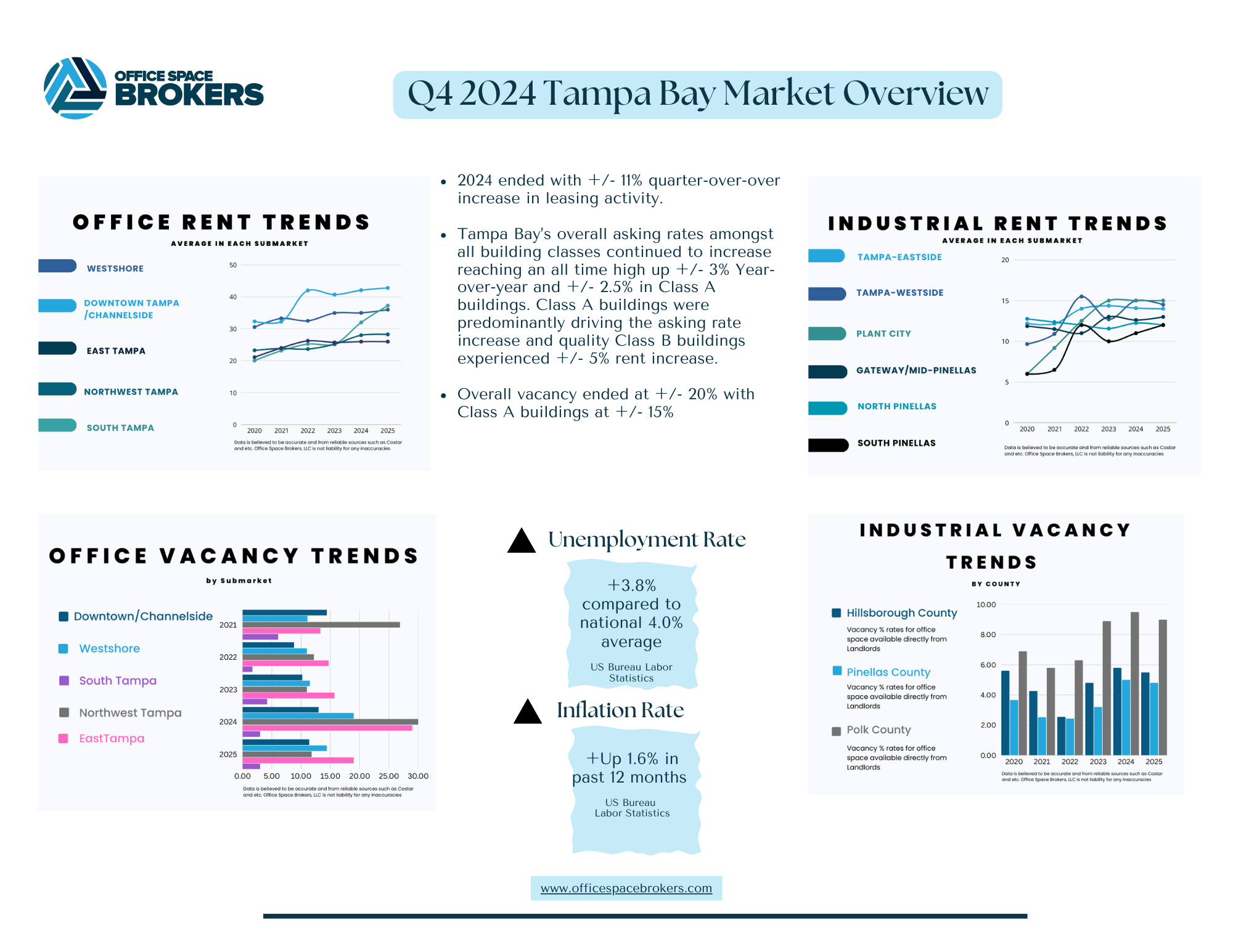

Economic Factors:

- Although Tampa Bay’s unemployment rate increased to 3.8% in Q4, it still falls below the national rate of 4.0%.

- “The area’s private sector employment increased by 17,500 jobs (+1.2 %) over the year in December 2024. In December 2024, the Tampa metro area also led the metro areas in job gains over the year in education and health services, adding 7,900 jobs; and information, adding 1,500 jobs” says the Florida Commerce.

- Inflation Rate was up 1.6% as of Nov. 2024 in past 12 months via the US Bureau Labor Statistics.

- Per the Regional Competitiveness Report, “Tampa Bay is once again first in net migration and in the top five for in-migration ages 25-34 and business startup rates.”

Key Metrics in the Office Market:

- 2024 ended with +/- 11% quarter-over-over increase in leasing activity.

- Tampa Bay’s overall asking rates amongst all building classes continued to increase reaching an all time high up +/- 3% Year-over-year and +/- 2.5% in Class A buildings. Class A buildings were predominantly driving the asking rate increase and quality Class B buildings experienced +/- 5% rent increase.

- Majority of leasing activity occurred in Westshore Business District.

- Overall vacancy ended at +/- 20% with Class A buildings at +/- 15%

Let’s Talk Rent Numbers:

| Submarket | Overall Average Asking Rent-All Classes | Overall Asking Rent Class A |

| Westshore | $36.00 Sq. Ft. | $41.25 Sq. Ft. |

| Downtown Tampa | $42.80 Sq. Ft. | $45.00 Sq. Ft. |

| Northwest Tampa | $28.25 Sq. Ft. | $32.65 Sq. Ft. |

| South Tampa | $37.25 Sq. Ft. | N/A |

| I-75 Corridor | $26.00 Sq. Ft. | $27.20 Sq. Ft. |

| Downtown St. Petersburg | $38.75 Sq. Ft. | $39.50 Sq. Ft. |

Building Highlights:

- Midtown East: The Primary new office construction of 85,000 SF is the second phase of Midtown Tampa, mixed use project located in the heart of Tampa. 50,000 SF has already been preleased.

2025 1st Quarter Forecast:

-

- Labor Market: Hiring expected to slow down and unemployment will remain under the national average

- Job Creation: “Tampa Bay’s technology sector is on a robust growth trajectory, with significant developments anticipated in 2025. The region has experienced a 30% increase in IT job growth, over the past five years, and is projected to add over 3,700 jobs by 2027, marking a 14% growth, according to the City of Tampa.”

- Supply: Vacancy rates expected to remain the same.

- Demand: Class A office space is projected to drive the majority of leasing with the flight to quality trend remaining strong and companies being strategic with their office location and amenities. South Tampa and medical office in particular will continue to be in high demand.

- Economic Indicators: Insurance premiums are rising impacting impacting commercial real estate, both Tenants and Landlords. Commercial construction might slow down.

What does this mean for Tenants?

Advantages:

- Companies who desire to be in suburban areas such as Northwest Tampa in near Hillsborough Avenue/ Veterans Expressway and Carrollwood and I-75 Corridor, have more negotiating leverage on rental rate and lease concessions due to the higher vacancy rates in buildings.

- Tenants in the 10,000 + Square Foot range have a stronger position across all Submarkets when negotiating with Landlords.

Challenges:

- Flexible work schedules with a mix of in office and work from home, continues to be a work in progress as companies evaluate what is best for their team. Every industry is different and everyone company is different.

- Class A may continue to trend higher with limited new construction forecasted in the future and the flight to quality and work where you live trend.

- The continued shift of focusing on strategic office location with surrounding amenities and environment that compel employees to want to come into the office can drive companies to the same Submarkets and buildings, creating vacancies in less desirable buildings and competition in others.

Considerations:

- Allowing plenty of lead time before a lease ends is vital when evaluating Westshore and Downtown Tampa Core for a relocation or expansion.

- If Tenants are finding themselves in place of uncertainty for their office space, Coworking solutions have become very common in Tampa Bay, providing a mix of individual offices and conference rooms to be used for monthly and quarterly meetings.

- Companies footprints and office schedules are shifting, under 5,000 Square Feet office spaces may have more competition that pre-pandemic.

- Tenants who are considering subleasing their space, positioning the space below market rent and (if there is a long remaining lease term) considering offering shorter lease terms for companies are looking for shorter lease terms Landlords typically do not agree to will provide an advantage among other spaces.

What does this mean for Landlords?

Opportunities:

- Carving up larger office Suites for < 5,000 Square Feet Tenant’s to lease, although a high initial investment, can pay off long term with diversification of leases rolling and smaller vacancies.

- Landlords with buildings located in Downtown Tampa Core or Westshore Business District, with onsite and nearby amenities should experience the most leasing activity and ability to be more selective when evaluating Tenants.

Challenges:

- Buildings located in suburban corridors like the Northwest and i-75 are experiencing the highest vacancy rates with companies minimizing their office footprints and focusing on prime locations.

Considerations:

- Landlord’s in high vacancy areas, can offer additional incentives for Tenants with shorter lease terms, higher Tenant Improvement allowance and rent abatement to incentivize companies to consider a building and location they typically would not.

- Frequency of office space use and operational layouts are being reimagined and repurposed, consider providing conference room space for Tenants who only need use of a conference room on a monthly or quarterly basis.