Economic Performance & Employment Trends:

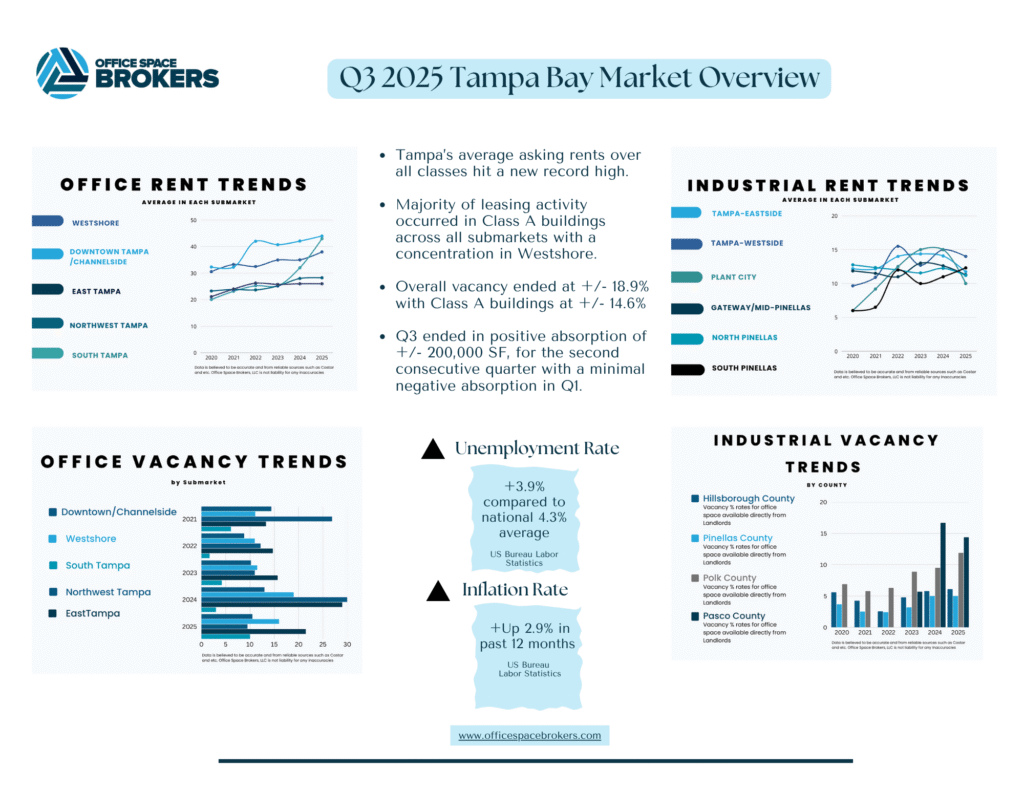

- Although Tampa Bay’s unemployment rate increased to 3.9% in Q3 and is up from 3.5% from Q3 2024. Still falls below the national rate of 4.3%.

- “FloridaCommerce announced that the Tampa metro area added 16,400 jobs (+1.2%) in the private sector over the year in July 2025 and has exceeded the national rate for 50 of the last 52 months,” FloridaCommerce.

- “The area gained the third-highest number of private sector jobs and led the metro areas in job gains over the year in July 2025 in manufacturing, adding 1,600 jobs. Industry gaining the most jobs over the year in the Tampa metro area was education and health services, adding 5,600 jobs” says FloridaCommerce.

- Inflation Rate was up 2.9% as of August 2025 over the past year via the US Bureau Labor Statistics.

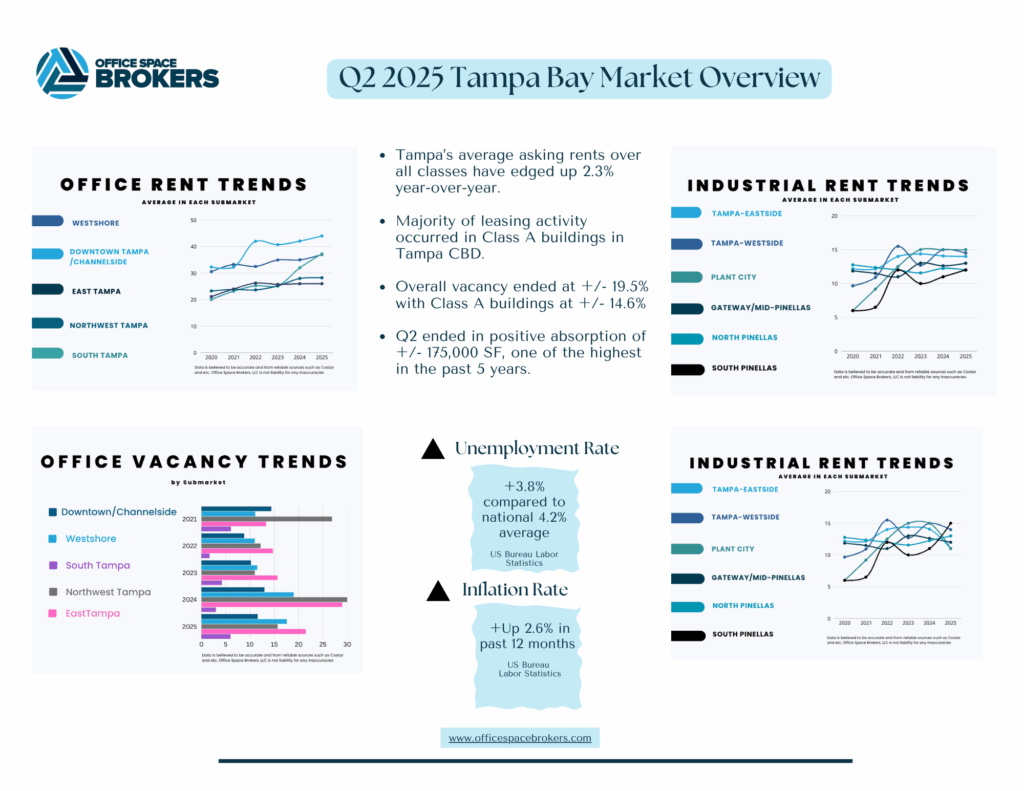

Key Metrics in the Office Market:

- Tampa Bay’s average asking rents over all classes have climbed again and hit a record high, Approx. 3.0% year-over-year, driven primarily by a 5% increase in Class A rates, compared to just a Approx. 2% bump for Class B assets. The pricing differential between urban and suburban Class A properties continues to widen.

- Consistent with Q2, majority of leasing occurred in Class A buildings with over 65% of the activity, reflecting the preference of quality building by Tenants

- Overall vacancy ended at +/- 18.9% with Class A buildings at +/- 14.6%

- Q3 ended in positive absorption of +/- 200,000 SF, for the second consecutive quarter with a minimal negative absorption in Q1.

Let’s Talk Rent Numbers:

| Submarket | Overall Average Asking Rent-All Classes | Overall Asking Rent Class A |

| Westshore | $37.89 Sq. Ft. | $43.88 Sq. Ft. |

| Downtown Tampa | $43.13 Sq. Ft. | $45.62 Sq. Ft. |

| Northwest Tampa | $26.28 Sq. Ft. | $27.56 Sq. Ft. |

| South Tampa | $43.00 Sq. Ft. | $52.00 Sq. Ft. |

| I-75 Corridor | $25.78 Sq. Ft. | $26.05 Sq. Ft. |

| Downtown St. Petersburg | $41.02 Sq. Ft. | $45.69 Sq. Ft. |

New Construction Pipeline:

- Midtown East: The first New Class A building built since 2021 which is 131,790 SF and the second phase of Midtown Tampa, mixed use project located in the heart of Tampa. Since its deliver, 60% vacancy remaining. Midtown East delivery was part of the reason of the vacancy increase in Westshore during 2nd Qtr. which improved in the 3rd Qtr.

- Ybor: 92,530 SF for Grow Financial in Ybor broke ground in 2nd quarter where Grow Financials new headquarters will be located from i-75 area.

2025 4th Quarter Forecast:

- Labor Market: Hiring expected to slow down and unemployment will remain under the national average

- Job Creation: Estimated net job growth: 12–18k new jobs and growth rate: ~1–1.5% quarterly (3–6% annualized)

- Supply: Based on the 5 previous quarters of decreasing vacancy rates, they are expected to continue to decrease.

- Demand: Class A office space is projected to continue to be the leader in leasing with the flight to quality trend remaining strong and companies being strategic with their office location and amenities. South Tampa and medical office in particular will continue to be in high demand.

- Economic Indicators: Insurance premiums and Real Estate Taxes continue both Tenants and Landlords, increasing building Operating Expenses with “new normal” highs. A slow hurricane season [so far] should aid in keeping insurance premiums consistent.

What does this mean for Tenants?

Advantages:

- Companies who desire to be in suburban areas such as Northwest Tampa in near Hillsborough Avenue/ Veterans Expressway and Carrollwood and I-75 Corridor, have more negotiating leverage on rental rate and lease concessions due to the higher vacancy rates in buildings.

- Tenants in the 10,000 + Square Foot range have a stronger position across all Submarkets when negotiating with Landlords. Especially with the most notable leases in the 3rd quarter were 10,000 SF-25,000 SF

Challenges:

- Every industry is different and every company is different when determining hybrid work schedules [if any]. Gaging top performing employees and where the most ideal employees you plan on recruiting live, will assist office site selection.

- Class A rents across all submarket will continue to increase as supply tightens.

- Companies who have part time or full time office policies and do not have their office among highly amenitized and quality buildings, could negatively impact recruiting abilities for employees to seek more favorable location and atmosphere if they are required to be in office.

Considerations:

- Due to low vacancy in a submarket like Tampa CBD, allow plenty of lead time before a lease ends is vital when considering a relocation or expansion.

- Evaluating submarkets outside of Westshore or Tampa CBD, will provide more favorable rental rate and lease terms.

- If Tenants are finding themselves in place of uncertainty for their office space, Coworking solutions have become very common in Tampa Bay, providing a mix of individual offices and conference rooms to be used for monthly and quarterly meetings.

- Tenants who want to subleasing their space, positioning the space below market rent and free rent will position the space to be the frontrunner with competitors.

What does this mean for Landlords?

Opportunities:

- Class A buildings are experiencing the most leasing activity. If a building is not Class A, consider adding features Tenants find valuable.

- Outlying areas such as Northwest Tampa and outside of Westshore and the CBDs, have the opportunity to capture Tenant’s who have been priced out.

Challenges:

- Buildings located in suburban corridors like the Northwest and i-75 are experiencing the highest vacancy rates with companies minimizing their office footprints and focusing on prime locations.

Considerations:

- Landlord’s in high vacancy areas, can offer additional incentives for Tenants with shorter lease terms, higher Tenant Improvement allowance and rent abatement to incentivize companies to consider a building and location they typically would not.

- Frequency of office space use and operational layouts are being reimagined and repurposed, consider providing conference room space for Tenants who only need use of a conference room on a monthly or quarterly basis.