3rd Quarter Tampa Bay Highlights:

Tampa Bay:

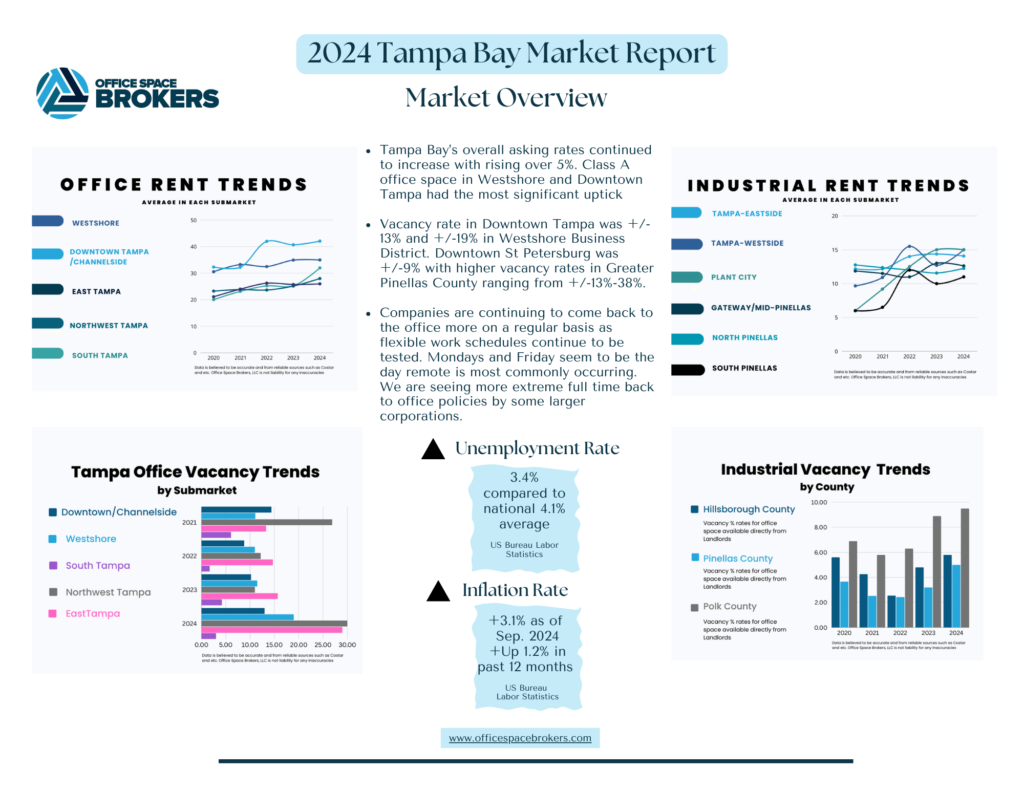

- Although Tampa Bay’s unemployment rate increased to 3.4% in Q3, it still falls below the national rate of 4.1%

- Inflation Rate is up is 3.1% as of Sep. 2024 and up 1.2% in past 12 months via the US Bureau Labor Statistics

- A low cost of living and a strong job market helped to secure the 4th place ranking on the Wall Street Journal’s hottest job markets in the U.S. Another important aspect of Tampa Bay’s incredible economy that has led to new business relocation is the agreeable tax environment.

Office Market:

- Tampa Bay’s overall asking rates continued to increase with rising over 5%. Class A office space in Westshore and Downtown Tampa had the most significant upturn to +/- $41.00 PSF in Westshore and +/-$43.50 PSF in Downtown Tampa.

- Vacancy rate in Downtown Tampa was +/- 13% and +/-19% in Westshore Business District. Vacancy rate in the Northwest and I-75 corridor in Tampa are significantly higher between +/-29% – +/-31%. Downtown St Petersburg was +/-9% with higher vacancy rates in Greater Pinellas County ranging from +/-13%-38%.

Let’s Talk Rent Numbers:

| Submarket | Overall Average Asking Rent-All Classes | Overall Asking Rent Class A |

| Westshore | $35.00 Sq. Ft. | $41.00 Sq. Ft. |

| Downtown Tampa | $42.09 Sq. Ft. | $43.50 Sq. Ft. |

| Northwest Tampa | $28.34 Sq. Ft. | $31.11 Sq. Ft. |

| South Tampa | $30.00 Sq. Ft. | N/A |

| I-75 Corridor | $26.20 Sq. Ft. | $26.67 Sq. Ft. |

| Downtown St. Petersburg | $35.90 Sq. Ft. | $37.16 Sq. Ft. |

Building Highlights:

- Tampa International Airport: With Phase 1 of the renovations complete, Tampa International Airport sets its sights on Phase 2 of the expansion plan, which features a new pedestrian bridge, curbside express lanes and more.

- Historic Gas Plant District: Construction on the largest development project in Tampa Bay history is slated to begin in early 2025. The phase one vertical development is promised to bring new housing, office space, meeting space and more to benefit all.

2024 3rd Quarter Forecast:

-

- Labor Market: The influx of new jobs from Fortune 500 company relocation to the Tampa Bay area are a huge benefit to the economy.

- Job Creation: Nonfarm employment grew by 25,900 jobs, or 1.7%, over the past year.

- Supply: This marks the steepest quarterly improvement of vacancy rates since Q4 2017 and puts Tampa Bay in a great spot to continue to see the vacancy rates decrease into Q4.

- Demand: This brought the year-to-date (YTD) total to 2.0 msf, a 14.1% decline compared to the same period in 2023. Thanks to influential accounting firms of PricewaterhouseCoopers and Clifton Larson Allen renewing their leases, the future looks promising.

- Economic Indicators: The Tampa Bay MSA’s unemployment rate is likely to remain at 3.4%, which is significantly lower than the national rate of 4.1%. Employment is anticipated to continue growing in the region.

What does this mean for Tenants?

Advantages:

- Companies who desire to be in auburn areas outside of the Downtown Core in Tampa and St. Petersburg and Westshore Business District, may have more negotiating leverage on rental rate and lease concessions due to the higher vacancy rates in buildings.

Challenges:

- Class A may continue to trend higher with limited new construction forecasted in the future and current trend of companies focusing on location of their office and surrounding amenities.

- There is over 300,000 RSF is for sublease in Westshore, giving Tenants who are in the market for sublease space the ability to shop around for the deal with the most favorable terms.

Considerations:

- Allotting plenty of lead time before a lease ends is vital when evaluating Westshore and Downtown Core for a relocation or expansion. Vacancy rates are low and which creates competition for desirable available space.

- Tenants are considering subleasing their space, positioning the space below market rent and if there is a long remaining lease term, considering offering shorter lease terms for companies are looking for shorter lease terms Landlords typically do not agree to.

What does this mean for Landlords?

Opportunities:

- Landlords with buildings located in Downtown Core or Westshore Business District, with onsite and nearby amenities should experience the most leasing activity and ability to be more selective when evaluating Tenants.

Challenges:

- Buildings located in suburban corridors like the Northwest and i-75 are experiencing the highest vacancy rates with companies minimizing their office footprints and focusing on prime locations.

Considerations:

- Offer additional incentives for Tenants with shorter lease terms, higher Tenant Improvement allowance and rent abatement to incentivize companies to consider a building and location they typically would not.